Average Dump Truck Insurance Cost Per Month (2024 Guide)

Average Dump Truck Insurance Cost Per Month (2024 Guide)

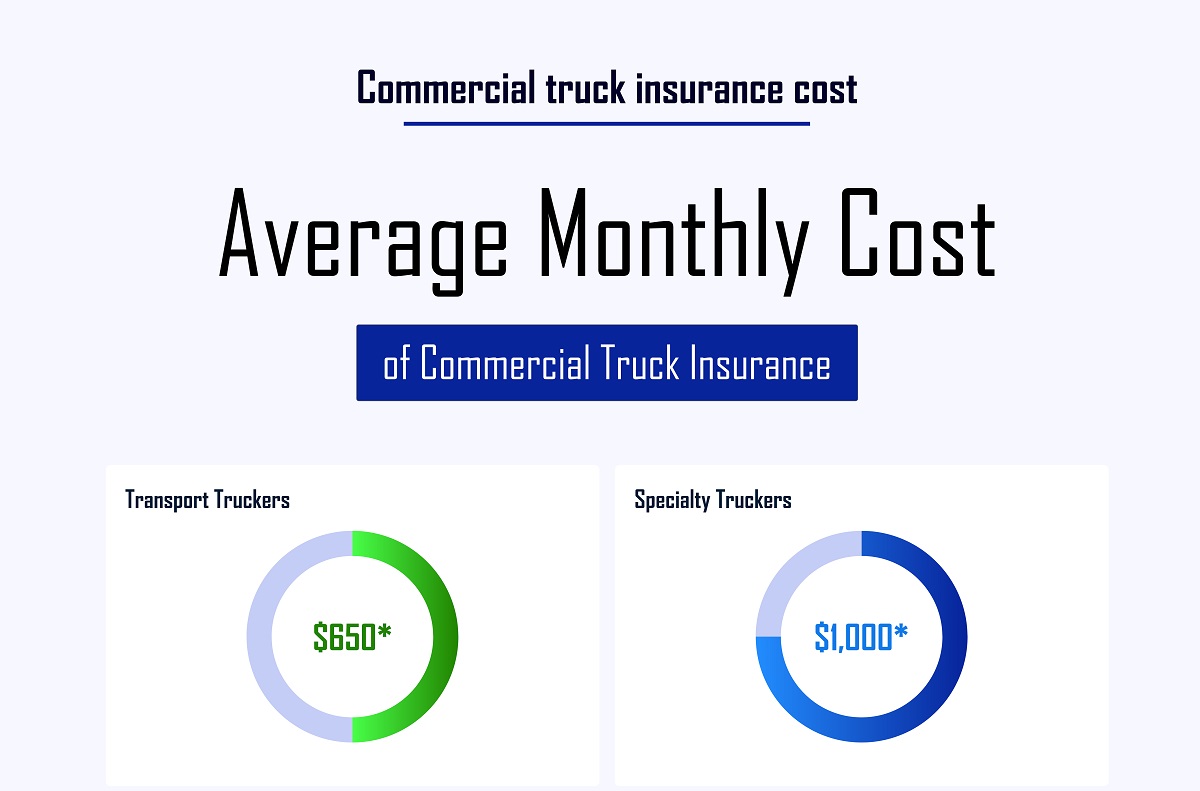

If you’re running a dump truck business, one of your biggest recurring expenses is likely your insurance premium. So, what’s the average dump truck insurance cost per month? While the national average typically falls between $400 and $900 monthly, your actual bill could be significantly higher or lower. The final cost isn’t a one-size-fits-all number; it’s a custom calculation based on your specific operation, driving history, and the value of your assets. This guide will break down all the factors that determine your premium, show you how different types of coverage affect the price, and provide actionable tips to lower your monthly insurance costs without sacrificing critical protection.

What Factors Drive Your Dump Truck Insurance Premium?

Insurance companies assess risk, and your premium is a direct reflection of the risk they believe you represent. Understanding these factors is the first step to managing your costs.

- Driving Records: This is paramount. A clean record for you and your drivers is the single best way to secure a lower rate. Even a single major violation can cause your premium to spike.

- Business Location: Where you operate and garage your trucks heavily influences the cost. Areas with high traffic density, higher rates of theft, or severe weather patterns often see higher premiums.

- Cargo and Hauling Type: What you haul matters. Transporting sand and gravel is viewed differently than hauling hazardous materials. Higher-risk cargo equals higher liability and, consequently, a higher insurance cost.

- Vehicle Value and Specifications: The make, model, year, and value of your dump truck are key factors. A brand-new, expensive truck will cost more to insure than an older, well-maintained model. Safety features can sometimes lead to discounts.

- Years of Experience and Safety Programs: Insurers reward experience. A company with a long, incident-free history will pay less. Implementing a formal safety program and providing regular driver training can also demonstrate lower risk to insurers.

Breaking Down the Types of Dump Truck Insurance Coverage

Your policy isn’t a single product but a bundle of different coverages. Knowing what each one does helps you build a policy that fits your needs and budget.

Primary Liability Insurance

This is the foundation and is legally required for all commercial trucks. It covers bodily injury and property damage that you cause to others in an at-fault accident. Limits are crucial here; carrying only the minimum state-required limits can be a financial disaster if a major accident occurs.

Physical Damage Coverage

This protects your own dump truck. It’s split into two parts:

- Collision Coverage: Pays for damage to your truck from an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision events like theft, vandalism, fire, or hitting an animal.

Cargo Insurance

This covers the materials you are hauling. If you spill a load of gravel on the highway or the cargo is damaged in a collision, this coverage pays for the loss. The required limit often depends on the value of the materials you typically transport.

Motor Truck Cargo Insurance

A specific and crucial type of cargo coverage for haulers. It protects the shipped goods from point A to point B and is often required by your contracts.

| Coverage Type | What It Protects | Is It Required? |

|---|---|---|

| Primary Liability | Other people’s injuries/property | Yes, by law |

| Physical Damage | Your dump truck | No, but often required by lenders |

| Cargo Insurance | The materials you’re hauling | Often required by contract |

Real Cost Scenarios: What Are Other Operators Paying?

Let’s look at some real-world examples to give you a better frame of reference. These are based on aggregated industry data and should be used as a guide, not a guarantee.

- Owner-Operator, Single Truck: An independent owner with one older dump truck, a clean record, and basic coverage (liability, physical damage, cargo) might see a monthly dump truck insurance cost between $350 and $600.

- Small Fleet, 3-5 Trucks: A small company with a mix of newer and older trucks, good safety records, and higher liability limits could pay an average of $500 to $800 per truck, per month. Fleet discounts often apply here.

- Large Fleet with Specialized Hauling: A larger operation hauling higher-risk materials will face the highest premiums, easily ranging from $900 to $1,500+ monthly per truck due to the increased liability and cargo value.

According to a recent report from the American Transportation Research Institute, insurance premiums represent one of the top five operational costs for trucking businesses, underscoring the importance of smart shopping. (Source: American Transportation Research Institute).

Expert Tips to Lower Your Monthly Insurance Bill

You don’t have to just accept the first quote you get. As John Miller, a commercial transportation risk advisor with over 20 years of experience, states, “Proactive risk management is the most powerful tool a dump truck owner has to control insurance expenses. Insurers are looking for partners, not problems.”

- Shop Around and Compare: Never renew a policy without getting at least three competitive quotes from different providers. The market changes constantly.

- Increase Your Deductible: Opting for a higher deductible on your physical damage coverage can significantly lower your monthly premium. Just ensure you have the cash reserves to cover that deductible if needed.

- Bundle Your Policies: Many insurers offer a “business owner’s policy” (BOP) that can bundle your truck insurance with general liability or other coverages at a discounted rate.

- Invest in Safety Technology: Equipping your trucks with telematics, dash cams, and electronic logging devices (ELDs) can demonstrate a commitment to safety and often qualifies you for a discount.

- Ask About Discounts: Inquire about pay-in-full discounts, claims-free discounts, or association membership discounts. You have to ask to receive.

Frequently Asked Questions (FAQ)

What is the cheapest way to get dump truck insurance?

The cheapest way is to maintain a flawless safety record for all drivers, choose coverage limits and deductibles wisely, and actively shop around with multiple independent agents who can compare quotes from several companies at once.

Is liability-only coverage a good way to save money?

While it is cheaper upfront, it’s a major risk. Liability-only insurance does not cover damage to your own dump truck. If your truck is your livelihood, a single accident could put you out of business if you can’t afford to repair or replace it.

How often should I review my dump truck insurance policy?

You should conduct a full review of your policy and shop for new quotes at least once a year before renewal. You should also review it anytime your business changes, such as adding a new truck, hiring a driver, or changing the type of materials you haul.

Do I need non-trucking liability (bobtail) insurance?

If you are an owner-operator who is sometimes under dispatch and sometimes driving for personal reasons, bobtail insurance is crucial. It covers you when you’re driving the truck without a trailer or not on active dispatch, filling a gap in your primary liability coverage. (Source: Federal Motor Carrier Safety Administration).

Final Thoughts

Finding the right dump truck insurance isn’t just about finding the lowest monthly premium; it’s about securing value. The right policy protects your business from catastrophic financial loss, allowing you to operate with confidence. By understanding the cost factors, tailoring your coverage, and implementing risk-reduction strategies, you can find a policy that offers robust protection at a fair price. Don’t set and forget your insurance—make it an active part of your business strategy.

Sources:

American Transportation Research Institute – Analysis of the Operating Costs of Trucking

Federal Motor Carrier Safety Administration (FMCSA)