- Financial Risk: If the truck breaks down, you still have to make the lease payment. A single major repair can devastate your weekly profit.

- Less Freedom: You are generally required to haul the loads the company assigns you. Your ability to choose your routes and home time is more limited.

- Complex Contracts: Some programs have clauses that can make it difficult to actually own the truck or build equity. You must read and understand every detail.

5 Critical Questions to Ask Before You Sign

Don’t walk into a lease purchase office unprepared. Arm yourself with these essential questions.

- What is the total buyout price? Get this in writing. It should include the truck’s cost plus any fees.

- What happens if the truck has a major mechanical failure? Understand your responsibility and if there’s any warranty or assistance.

- What is the exact revenue split? Is it a percentage of the load? Are there fixed deductions? Get a sample settlement sheet.

- Is there a mileage or weekly payment minimum? This guarantees you have to pay a certain amount even during slow weeks.

- Can I speak with current drivers in your program? A reputable company will connect you with drivers who can share their real-world experience.

Is an Illinois Lease Purchase Right for You?

This path isn’t for everyone. It’s best suited for disciplined, business-minded drivers with a solid safety record and a strong understanding of the costs involved in running a truck. You need to be a skilled operator and a part-time accountant. If you thrive on the absolute freedom of the open road and want to be your own boss in every sense, saving for a traditional loan to become a full independent owner-operator might be a better long-term fit. However, if you value the structure and support of a larger carrier while working toward ownership, a well-vetted lease to own trucking company in Illinois could be your ticket to the driver’s seat of your own business.

Frequently Asked Questions

What credit score is needed for a truck lease purchase in Illinois?

Credit requirements vary widely. Some companies are more concerned with your driving record and work history than a perfect credit score. However, a score above 600 will generally open more doors. The key is to be upfront and ask the company directly about their minimum requirements.

Can I leave a lease purchase program early?

This is entirely dependent on the contract. Many have early termination fees that can be substantial. Some might allow you to walk away but you will forfeit all the equity you’ve built up. This is one of the most critical sections to review with a fine-tooth comb before signing.

Who pays for insurance in a lease purchase agreement?

Typically, the driver (you) is responsible for procuring and paying for liability, physical damage, and cargo insurance. The carrier usually arranges it and then deducts the premium cost from your settlement. This is a significant fixed cost that must be factored into your financial calculations each week.

Are there successful lease purchase trucking companies near Chicago?

Yes, the Chicago area, being a massive freight hub, is home to many carriers that offer these programs. The companies listed earlier, like Wilson Logistics, have a strong presence in the region. The key is not just finding a company “near you,” but one with a reputable program that aligns with your goals.

Sources and Further Reading

To ensure the accuracy and authority of this guide, we referenced information from the following established sources:

- American Trucking Associations: https://www.trucking.org/

- Federal Motor Carrier Safety Administration (FMCSA): https://www.fmcsa.dot.gov/

- Illinois Trucking Association: https://www.il-trucking.org/

Lease Purchase Trucking Companies in Illinois | Your Guide

If you’re a truck driver in Illinois dreaming of owning your own rig without the massive upfront cost, a lease purchase agreement might be your perfect route. This guide cuts through the noise to give you a clear, honest look at how lease purchase trucking companies in Illinois work. We’ll break down the pros, the cons, the key players, and the essential questions you need to ask before signing on the dotted line. Think of this as your roadmap to making an informed decision, helping you determine if this path leads to true ownership or just a long-term rental with your name on it.

What is a Truck Lease Purchase Program?

At its core, a truck lease purchase program is a financing arrangement. A trucking company allows a driver to lease a truck with the option to buy it at the end of the lease term. You make weekly or monthly payments from your earnings, and a portion of that payment typically goes toward the final purchase price. It’s different from a traditional bank loan because you’re dealing directly with a carrier. For many, it’s a stepping stone—a way to build equity and test the waters of business ownership without the steep credit requirements or down payment of a conventional loan. However, not all programs are created equal, and understanding the fine print is what separates a good deal from a financial trap.

Top Lease Purchase Trucking Companies in Illinois

Illinois, with its central location and major hubs like Chicago, is home to several carriers offering these programs. Here’s a look at some of the notable names, but remember, you must do your own deep research as company policies can change.

| Company | Program Highlights | Fleet Info | Key Consideration |

|---|---|---|---|

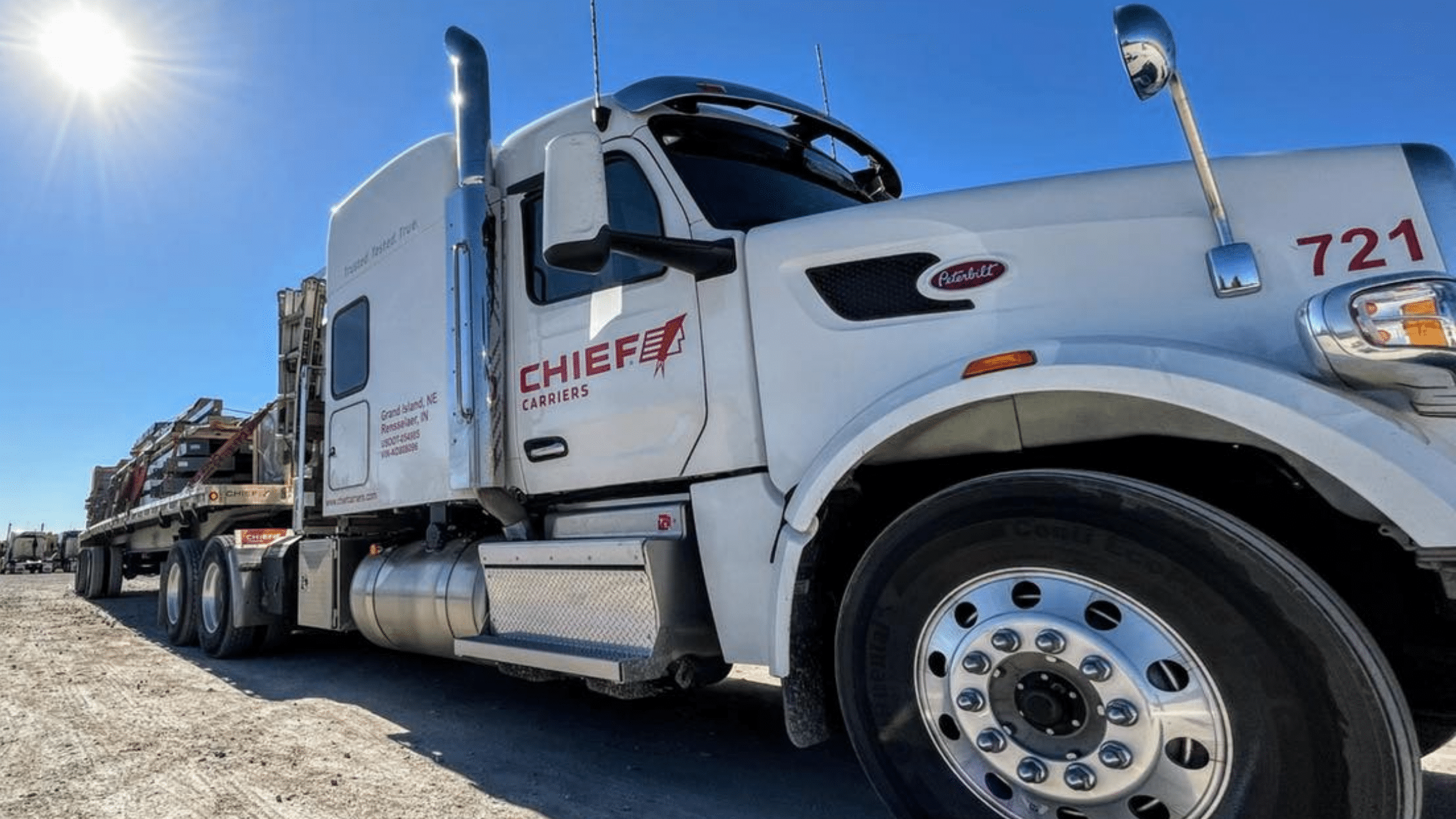

| Wilson Logistics | Offers a “Choose Your Own Truck” program with no money down. | Late-model Freightliners and Peterbilts. | Known for driver-focused support and mentorship. |

| Maverick Transportation | Flatbed-focused lease purchase with a clear buyout schedule. | Well-maintained fleet with consistent freight. | Strong reputation in the flatbed specialty. |

| Boss Truck Shops, Inc. | In-house service and parts network for lessees. | Variety of makes and models. | Convenience of integrated maintenance can be a major plus. |

This is just a snapshot. The best Illinois truck lease purchase company for you will depend on your hauling preferences, financial goals, and the specific terms of their contract.

Lease Purchase vs. Owner-Operator: A Side-by-Side Look

Is a lease purchase the same as being a full-fledged owner-operator? Not quite. Here’s a breakdown to clarify the differences.

- Start-up Costs: Lease purchase programs often require little to no down payment. Becoming an owner-operator usually means securing a bank loan, which demands a significant down payment and strong credit.

- Maintenance Responsibility: In most lease purchase deals, you are responsible for all maintenance and repairs, just like an owner-operator. This is a critical cost to factor in.

- Freight and Dispatching: A key difference. As a lease purchase driver, you are typically tied to the carrier’s freight network. This provides consistent loads but less freedom. Independent owner-operators can broker their own loads and have more control over where they go.

- Earning Potential: Owner-operators have an uncapped potential but also carry all the risk of finding freight. Lease purchase drivers have more predictable, carrier-managed freight, but the revenue split is determined by the company.

The Real Pros and Cons: An Unfiltered View

Based on driver testimonials and industry analysis, here’s the honest truth about what you’re signing up for.

Advantages

- Path to Ownership: It’s the primary draw. You can own a truck without a huge initial investment.

- Consistent Freight: Good companies provide a steady stream of loads, minimizing the dreaded deadhead miles. The American Trucking Associations notes that consistent freight is a top concern for small fleet viability.

- Support System: You often get access to the company’s fuel discounts, maintenance facilities, and back-office support.

Disadvantages

- Financial Risk: If the truck breaks down, you still have to make the lease payment. A single major repair can devastate your weekly profit.

- Less Freedom: You are generally required to haul the loads the company assigns you. Your ability to choose your routes and home time is more limited.

- Complex Contracts: Some programs have clauses that can make it difficult to actually own the truck or build equity. You must read and understand every detail.

5 Critical Questions to Ask Before You Sign

Don’t walk into a lease purchase office unprepared. Arm yourself with these essential questions.

- What is the total buyout price? Get this in writing. It should include the truck’s cost plus any fees.

- What happens if the truck has a major mechanical failure? Understand your responsibility and if there’s any warranty or assistance.

- What is the exact revenue split? Is it a percentage of the load? Are there fixed deductions? Get a sample settlement sheet.

- Is there a mileage or weekly payment minimum? This guarantees you have to pay a certain amount even during slow weeks.

- Can I speak with current drivers in your program? A reputable company will connect you with drivers who can share their real-world experience.

Is an Illinois Lease Purchase Right for You?

This path isn’t for everyone. It’s best suited for disciplined, business-minded drivers with a solid safety record and a strong understanding of the costs involved in running a truck. You need to be a skilled operator and a part-time accountant. If you thrive on the absolute freedom of the open road and want to be your own boss in every sense, saving for a traditional loan to become a full independent owner-operator might be a better long-term fit. However, if you value the structure and support of a larger carrier while working toward ownership, a well-vetted lease to own trucking company in Illinois could be your ticket to the driver’s seat of your own business.

Frequently Asked Questions

What credit score is needed for a truck lease purchase in Illinois?

Credit requirements vary widely. Some companies are more concerned with your driving record and work history than a perfect credit score. However, a score above 600 will generally open more doors. The key is to be upfront and ask the company directly about their minimum requirements.

Can I leave a lease purchase program early?

This is entirely dependent on the contract. Many have early termination fees that can be substantial. Some might allow you to walk away but you will forfeit all the equity you’ve built up. This is one of the most critical sections to review with a fine-tooth comb before signing.

Who pays for insurance in a lease purchase agreement?

Typically, the driver (you) is responsible for procuring and paying for liability, physical damage, and cargo insurance. The carrier usually arranges it and then deducts the premium cost from your settlement. This is a significant fixed cost that must be factored into your financial calculations each week.

Are there successful lease purchase trucking companies near Chicago?

Yes, the Chicago area, being a massive freight hub, is home to many carriers that offer these programs. The companies listed earlier, like Wilson Logistics, have a strong presence in the region. The key is not just finding a company “near you,” but one with a reputable program that aligns with your goals.

Sources and Further Reading

To ensure the accuracy and authority of this guide, we referenced information from the following established sources:

- American Trucking Associations: https://www.trucking.org/

- Federal Motor Carrier Safety Administration (FMCSA): https://www.fmcsa.dot.gov/

- Illinois Trucking Association: https://www.il-trucking.org/