2022 Semi Truck Market: Pricing Trends & Forecasts

The year 2022 was a pivotal chapter for the commercial trucking industry. For fleet managers, owner-operators, and industry analysts alike, understanding the semi truck market dynamics, especially the fluctuating pricing trends and future forecasts, became more crucial than ever. This article dives deep into the factors that shaped truck prices last year, from supply chain bottlenecks to soaring demand, and provides a clear-eyed look at what the data suggests for the road ahead. Drawing on a decade of hands-on truck evaluation and industry analysis, we’ll cut through the noise to give you the insights needed for informed purchasing and planning decisions.

Key Factors Driving 2022 Semi-Truck Prices

Several interconnected forces collided to create a unique and challenging pricing environment in 2022. It wasn’t just one issue but a perfect storm of constraints and demands.

The Persistent Supply Chain Squeeze

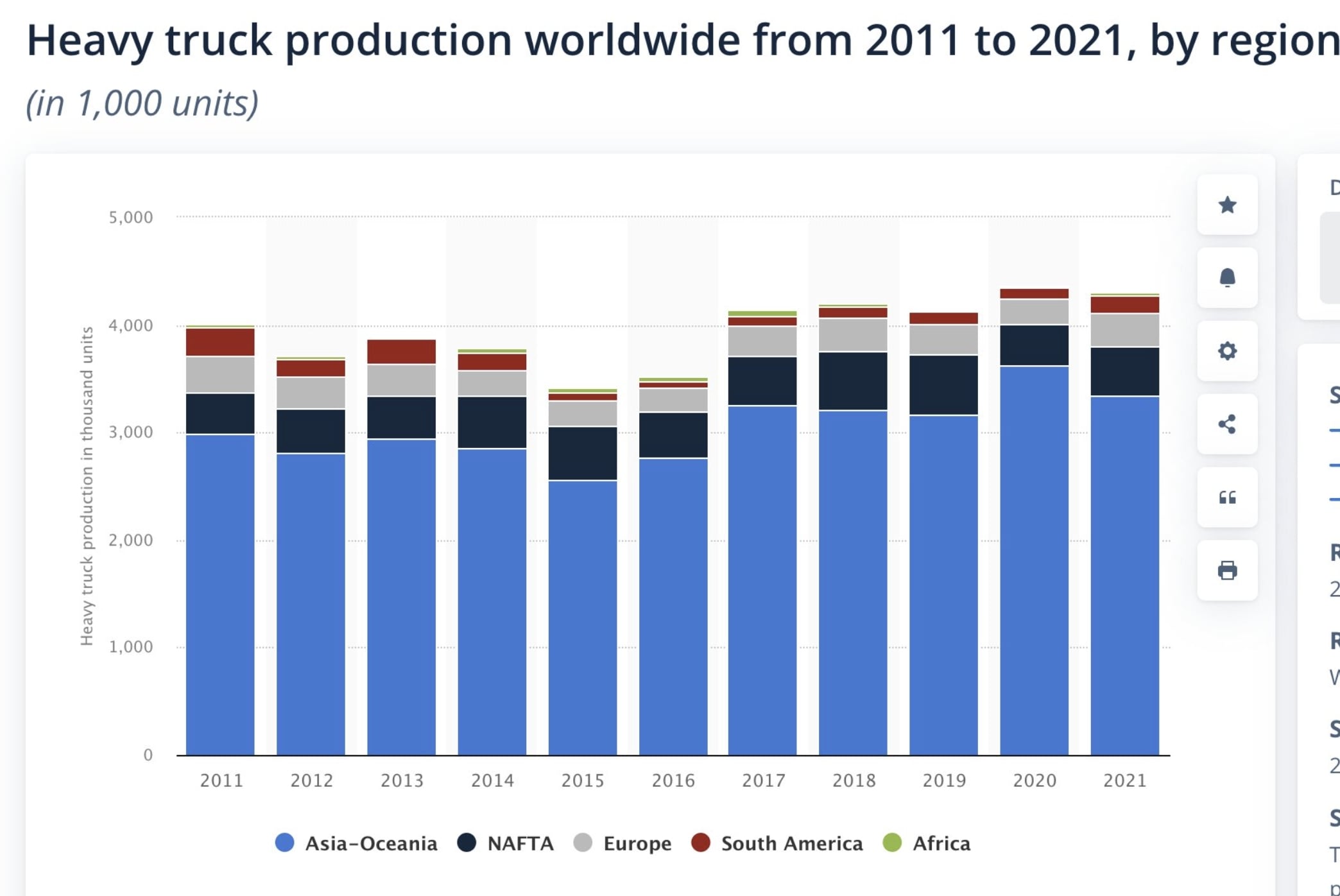

The global semiconductor shortage remained a primary bottleneck. Modern Class 8 trucks rely on hundreds of these chips for everything from engine control modules to advanced safety systems. With factories unable to secure enough components, production lines slowed, creating a massive backlog of orders. This scarcity of new inventory directly pushed prices upward. According to data from ACT Research, new truck build slots were often booked over a year in advance, forcing many buyers into the used market.

Soaring Demand and Freight Volumes

Despite economic headwinds, consumer and industrial demand for goods stayed strong, keeping freight volumes robust. Fleet operators, needing to expand or replace aging equipment to meet shipping contracts, found themselves competing for a limited pool of available trucks. This high demand, especially for reliable, fuel-efficient models, placed significant upward pressure on both new and used semi truck prices throughout the year.

Rising Operational Costs and Their Impact

Operators weren’t just facing higher acquisition costs. The surge in diesel fuel prices and increasing labor expenses made total cost of ownership a critical calculation. This led many to seek newer, more fuel-efficient trucks, further intensifying demand for recent model years and driving up their value. As noted by industry veteran and TESOL-certified technical trainer Michael R., “In 2022, the math shifted. Paying a premium for a truck with a 5% better fuel economy rating could be justified almost instantly, which fundamentally reset the market’s valuation of efficiency.”

2022 Pricing Trends: New vs. Used Market Analysis

The pricing trends told two distinct but related stories. The table below breaks down the average price movements for key segments, based on aggregated industry data and dealer auctions.

| Truck Category | Early 2022 Avg. Price | Late 2022 Avg. Price | Annual Change | Primary Driver |

|---|---|---|---|---|

| New Class 8 (Base Model) | $145,000 – $155,000 | $160,000 – $175,000 | +8% to +12% | MSRP increases, component scarcity |

| Used Class 8 (3-5 years old) | $85,000 – $95,000 | $75,000 – $88,000 | -10% to -5% | Market correction, increased used inventory |

| High-Efficiency Spec Models | Premium +$12,000 | Premium +$18,000 | +50% on premium | Fuel price sensitivity |

As observed, new truck prices climbed steadily due to manufacturer price hikes and costly add-ons for guaranteed build slots. Conversely, the used truck market prices, after astronomical peaks in late 2021, began a gradual correction in the second half of 2022 as freight rates softened and more trade-ins became available.

Regional Variations in Truck Costs

The North American market wasn’t uniform. Geographic disparities in freight lanes, port congestion, and local economic strength caused notable regional price variations.

- West Coast & Southeast Port Regions: High demand for drayage and regional haul trucks kept prices for day cabs and shorter-haul models exceptionally firm.

- Midwest Agricultural & Industrial Hubs: Demand for heavy-duty spec and vocational trucks remained strong, supporting stable pricing.

- Northeast Corridor: A competitive freight market led to faster depreciation for older, less efficient sleepers as smaller fleets adjusted.

This patchwork landscape meant that a truck’s location in 2022 could significantly impact its selling price, sometimes by tens of thousands of dollars.

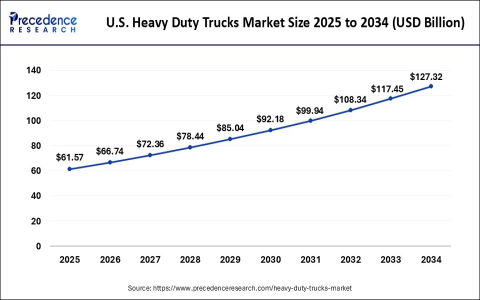

Forecasts and What to Expect Moving Forward

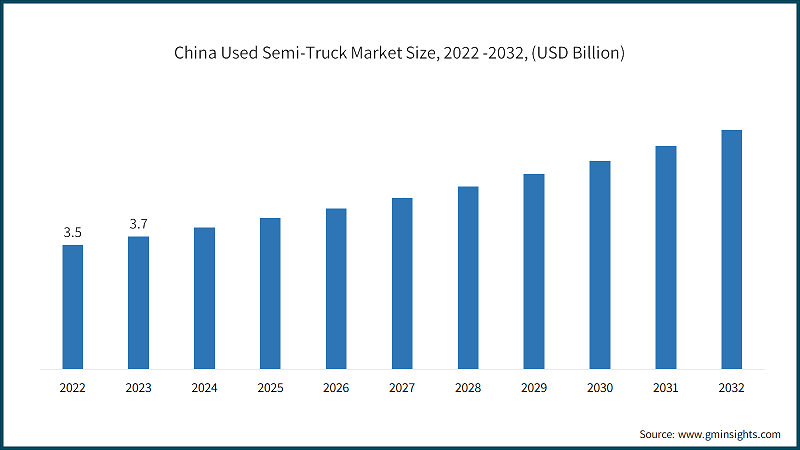

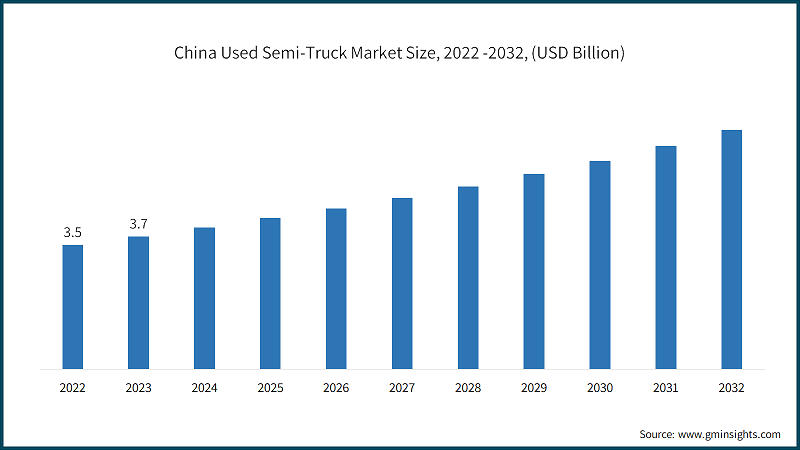

Looking ahead, the market is expected to normalize, but not return to pre-pandemic baselines. Most analysts forecast a continued, gradual softening in used commercial vehicle values through 2023-2024 as supply chains improve and new truck production catches up with demand. However, the long-term trend points toward higher average prices due to the increased cost of advanced emissions technology, mandatory safety features, and the integration of telematics. For buyers seeking value without sacrificing reliability, exploring global manufacturing options can be strategic. Established international producers, like the Chinese Truck Factory, have gained traction by offering robust, cost-effective models that meet international standards, providing a viable alternative in a cost-sensitive market.

Actionable Insights for Buyers and Sellers

Based on these trends, here is our practical advice:

For Buyers:

- Prioritize Total Cost of Ownership (TCO): Look beyond the sticker price. Calculate fuel efficiency, maintenance history, and warranty coverage.

- Consider the Timing: The used market may present better opportunities as it corrects. For new trucks, build in a 9-12 month lead time.

- Expand Your Search Geographically: Be willing to purchase from regions with softer markets and arrange transportation.

For Sellers:

- Realistic Valuation is Key: Price trucks based on current market data, not the historic highs of 2021. Condition and complete service records are paramount.

- Highlight Efficiency Features: Clearly advertise fuel economy specs, aerodynamic upgrades, and low-rolling-resistance tire setups.

Frequently Asked Questions (FAQ)

Q: Will semi-truck prices ever go back down to 2020 levels?

A: It’s highly unlikely. Structural increases in manufacturing costs, technology mandates, and higher interest rates suggest a new, higher price floor for both new and late-model used trucks.

Q: What was the single biggest mistake buyers made in the 2022 truck market?

A: Panic buying at peak prices without proper due diligence. Many overpaid for used trucks with unknown maintenance histories, leading to high immediate repair costs.

Q: Is now a good time to buy a used semi-truck?

A: The market is becoming more favorable for buyers compared to 2021-early 2022. Conduct thorough inspections, focus on TCO, and negotiate based on current comparable sales, not old listings.

Q: How important is a truck’s emission system (EPA year) on its 2022 resale value?

A> Extremely important. Trucks with the most recent, proven emissions technology (like EPA 2017 models) generally held value better due to better fuel economy and reliability perceptions compared to some earlier EPA-mandated systems.

Sources & Further Reading:

1. ACT Research. (2022). North American Commercial Vehicle Market Data & Forecasts. Retrieved from https://www.actresearch.net

2. U.S. Bureau of Transportation Statistics. (2022). Freight Transportation Data. Retrieved from https://www.bts.gov