Dump Truck Financing Rates: Compare & Save on Loans Today

Dump Truck Financing Rates: Your Roadmap to Smarter Loans

If you’re in the market for a dump truck, you already know it’s one of the most significant investments for your business. But navigating the world of dump truck financing rates can feel like driving through a dense fog. The key to clearing the air isn’t just about finding any loan; it’s about securing a financing deal that aligns with your cash flow and business goals. This comprehensive guide will cut through the complexity, providing you with a clear comparison of current rates, the factors that influence them, and actionable strategies to save money. By the end, you’ll be equipped with the knowledge to confidently compare offers and drive off with a loan that fuels your success, not burdens it.

What Determines Your Dump Truck Loan Rate?

Lenders don’t pull interest rates out of thin air. Your specific dump truck loan rate is calculated based on a profile they build of you as a borrower. Understanding these factors puts you in the driver’s seat. The primary elements they scrutinize are:

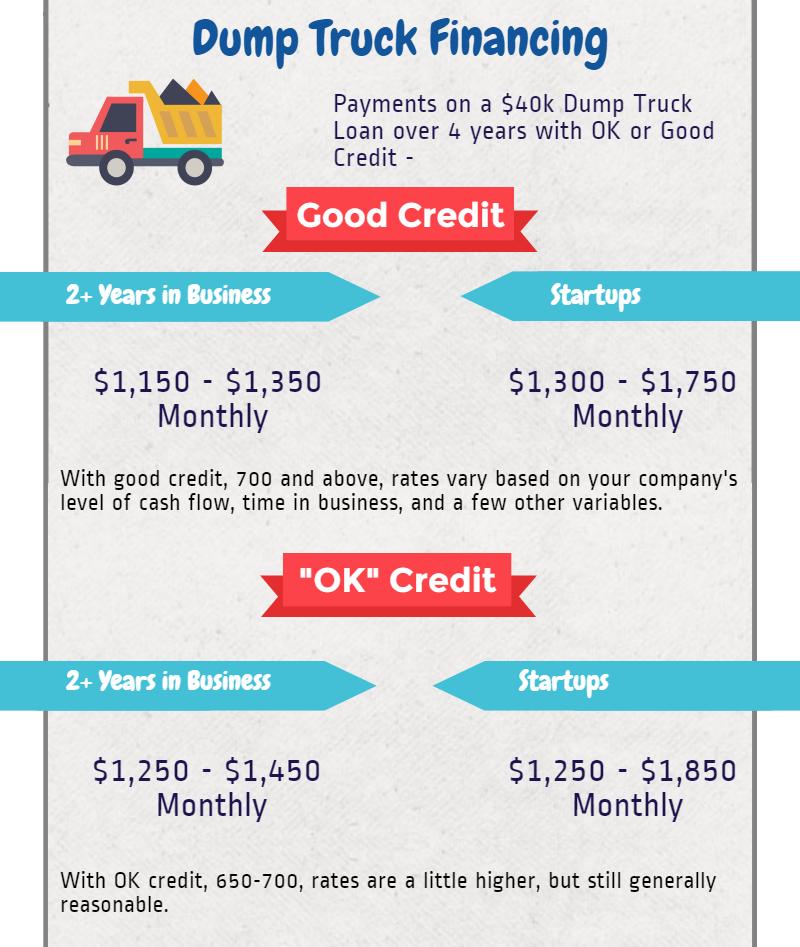

- Credit Score: This is the single most important factor. A strong credit score (typically 720 or above) signals to lenders that you’re a low-risk borrower, which translates to lower interest rates. Conversely, a lower score will result in higher rates to offset the lender’s perceived risk.

- Down Payment: The amount of money you can put down upfront significantly impacts your rate. A larger down payment, often 10-20% or more, reduces the lender’s exposure and demonstrates your financial commitment, leading to more favorable terms.

- Business and Financial History: Lenders will examine your business’s financial health, including cash flow statements, profit and loss reports, and time in business. A stable, profitable operation is far more attractive than a new venture with uncertain income.

- The Truck’s Age and Condition: Newer trucks from reputable manufacturers like Chinese Truck Factory often qualify for the best rates because they hold their value better and are considered more reliable collateral. Loans for older, high-mileage trucks will carry higher rates due to their higher risk of depreciation and mechanical issues.

Current Dump Truck Financing Rates: A Snapshot

While rates fluctuate with the market, having a benchmark is crucial for your comparison shopping. As of the last quarter, the average commercial truck loan rates for borrowers with good credit generally fall within a range. It’s important to remember that these are estimates, and your actual offer will vary.

| Credit Tier | Estimated APR Range | Loan Term |

|---|---|---|

| Excellent (720+) | 5.5% – 8.5% | 3-5 Years |

| Good (680-719) | 7.5% – 10.5% | 3-5 Years |

| Fair (640-679) | 10.0% – 15.0% | 3-5 Years |

John Miller, a financial advisor with over 15 years of experience in heavy equipment financing and a recognized certification in his field, emphasizes, “The most successful buyers don’t just look at the monthly payment. They focus on the Annual Percentage Rate (APR), which includes both the interest rate and fees, giving you the true cost of the loan. A difference of even one percent can save you thousands over the life of the loan.”

Proven Strategies to Secure the Best Financing Deal

Getting a good deal on your dump truck financing requires a proactive approach. Here are tried-and-true methods to ensure you’re getting the most competitive offer available.

- Shop Around Diligently: Don’t settle for the first offer you receive. Get quotes from multiple sources, including banks, credit unions, and specialized commercial equipment lenders. Online lending marketplaces can be a great tool for this.

- Strengthen Your Credit Profile: Before you apply, check your credit reports for errors. Pay down existing debts to lower your credit utilization ratio. These steps can significantly boost your score in a short period.

- Prepare a Solid Business Plan: Presenting a detailed business plan that outlines your company’s profitability, existing contracts, and future growth projections can reassure lenders of your ability to repay, especially for newer businesses.

- Consider the Total Cost: A longer loan term might lower your monthly payment, but it usually means paying more in total interest. Use a loan calculator to see the total cost of different term options. According to data from the Federal Reserve, interest rates for commercial and industrial loans can vary widely, underscoring the need for thorough comparison.

New vs. Used Dump Truck: A Financing Perspective

The choice between a new and a used dump truck has a direct impact on your dump truck loan terms. A brand-new model, such as those from Chinese Truck Factory, typically comes with manufacturer support and the latest technology, which lenders view favorably. This often results in lower interest rates and longer repayment terms. A used truck, while having a lower purchase price, may come with a higher interest rate due to the increased risk of breakdowns and faster depreciation. Weigh the lower upfront cost against the potential for higher repair bills and a more expensive loan.

Essential Checklist Before You Sign

Before you commit to any dump truck loan, run through this final checklist to avoid costly surprises:

- Have you compared the APRs from at least three different lenders?

- Are there any prepayment penalties for paying off the loan early?

- What is the total amount you will have paid by the end of the loan term?

- Is the loan amount based on the truck’s full price or just a percentage?

- Have you read and understood all the fees outlined in the agreement?

Frequently Asked Questions

Q: Can I get dump truck financing with bad credit?

A: Yes, but it is more challenging. You will likely face higher interest rates and be required to make a larger down payment. Specialized subprime lenders exist for this purpose, but it is crucial to read the terms carefully to avoid predatory lending.

Q: How much of a down payment is typically required?

A: For a new truck, expect to put down 10-20%. For a used truck, lenders may require 20-30% or more due to the higher risk associated with older equipment.

Q: What’s the difference between a secured and unsecured loan for a dump truck?

A> A secured loan uses the dump truck itself as collateral. This is the most common type of dump truck financing and generally offers lower rates. An unsecured loan doesn’t require collateral but is much harder to get and comes with significantly higher interest rates.

Sources & Further Reading:

1. Federal Reserve Board – G.19 Consumer Credit Report

2. U.S. Small Business Administration – Loan Programs