Dump Truck Insurance Rates: Key Factors & Cost Guide

Dump Truck Insurance Rates: Key Factors & Cost Guide

If you’re in the business of hauling dirt, gravel, or demolition debris, you already know that your dump truck is the backbone of your operation. But what about protecting that investment? Understanding dump truck insurance rates is not just a regulatory formality; it’s a critical component of your business’s financial health. The cost isn’t a random number. It’s a carefully calculated figure based on a myriad of factors specific to your truck, your driving habits, and your business operations. This guide will break down the key elements that determine your premium and provide a clear picture of what you can expect to pay, empowering you to make informed decisions and potentially lower your costs.

What Determines Your Dump Truck Insurance Premium?

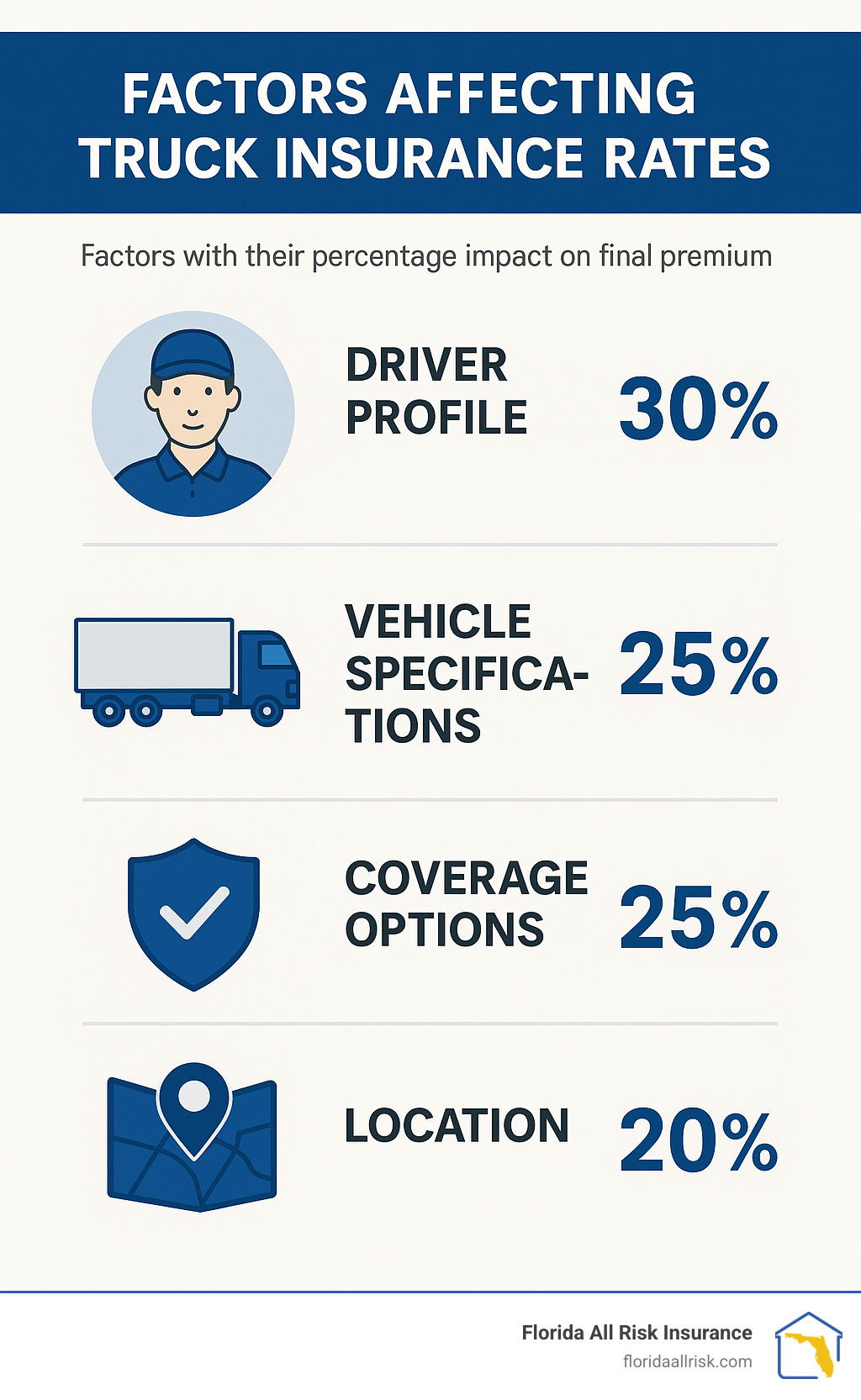

Insurance companies assess risk. The higher the perceived risk of a claim, the higher your dump truck insurance rates will be. They dive deep into your profile to build a risk assessment. Here are the primary factors they consider:

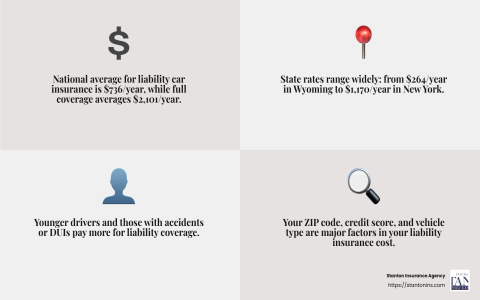

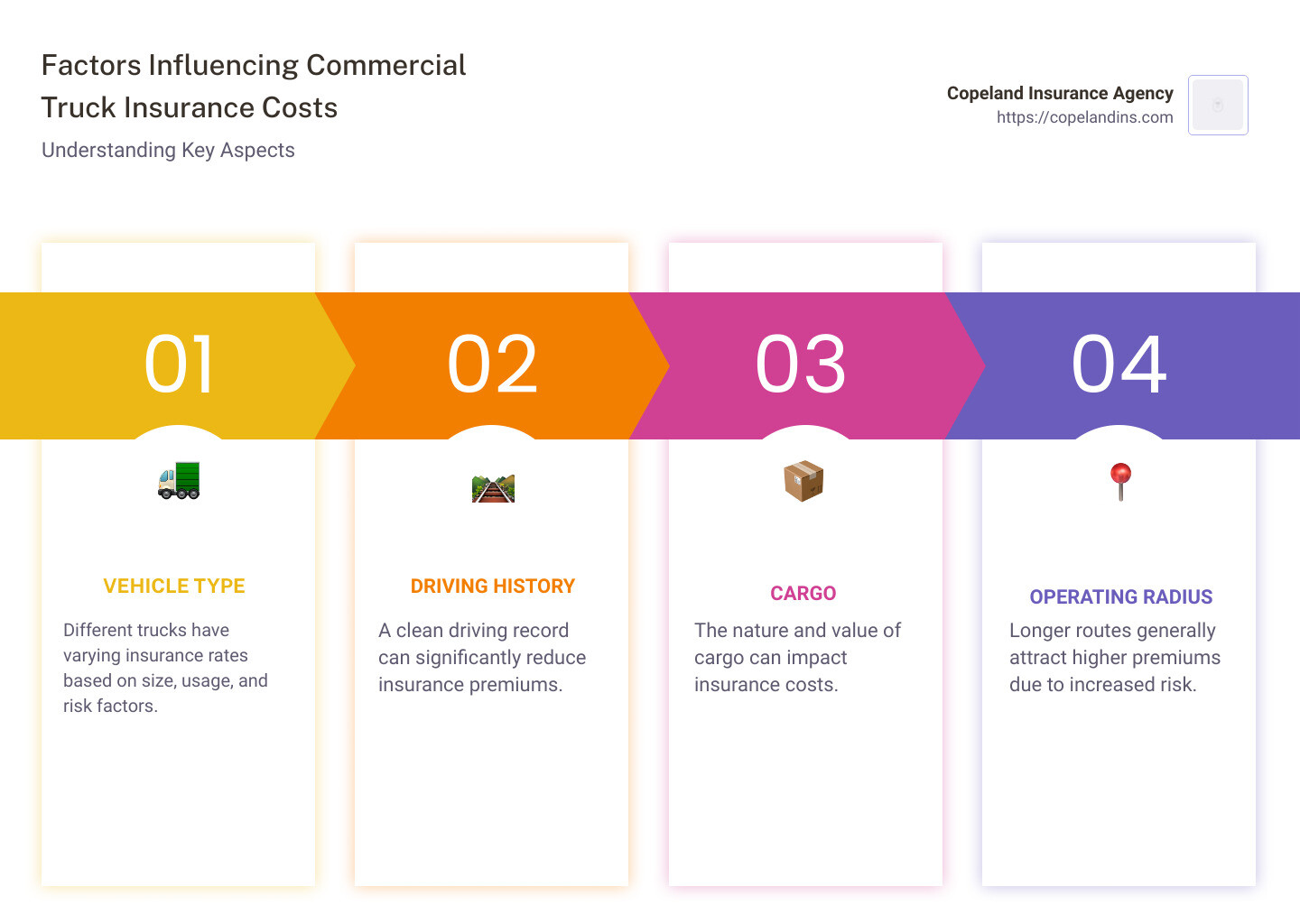

- Driving Record: This is paramount. A clean record with no accidents or moving violations signals to insurers that you are a responsible, low-risk driver. Even a single DUI or at-fault accident can cause your premiums to skyrocket.

- Business Experience: How long have you been in the dump truck business? Newer operators are often viewed as higher risk compared to seasoned veterans with a proven track record of safety and stability.

- Type of Cargo: What you haul directly impacts your liability. Transporting sand and gravel is considered standard risk. However, if you’re involved in hauling hazardous materials or demolition waste, the potential for a costly environmental cleanup or specialized incident increases your premium significantly.

- Vehicle Value and Specifications: The make, model, year, and value of your dump truck are fundamental. A brand-new, high-value truck will cost more to insure than an older, well-maintained model. The cost of replacement parts and the truck’s safety features are also factored in.

- Coverage Limits and Deductibles: This is the most direct lever you control. Higher coverage limits provide more protection but come at a higher cost. Conversely, opting for a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your monthly premium.

Breaking Down the Cost: What Can You Expect to Pay?

So, what are the actual numbers? While your final dump truck insurance cost will be unique, we can look at industry averages to set expectations. For a standard single-axle dump truck used in local hauling, annual premiums can range from $8,000 to $15,000. For larger operations with multiple trucks or long-haul routes, costs can easily exceed $25,000 per vehicle annually.

| Coverage Type | Typical Coverage Limit | Estimated Annual Cost |

| Primary Liability | $750,000 – $1,000,000 | $5,000 – $9,000 |

| Physical Damage | Actual Cash Value | $2,000 – $4,000 |

| Cargo Insurance | $100,000 | $500 – $1,500 |

These figures are estimates. Your location plays a huge role. Operating in a densely populated urban area with high traffic congestion will invariably lead to higher premiums than operating in a rural setting.

Essential Coverage Types for Your Dump Truck

Simply having insurance isn’t enough. You need the right insurance. A basic policy might leave massive gaps in your coverage. Here are the non-negotiable types of coverage for any serious dump truck operator:

- Primary Liability Insurance: This is legally required and covers bodily injury and property damage you cause to others in an at-fault accident.

- Physical Damage Coverage: This protects your own truck. It’s a combination of Comprehensive (for theft, fire, vandalism) and Collision (for damage from an accident).

- Cargo Insurance: This covers the materials you are hauling if they are damaged or lost in transit.

- Motor Truck Cargo Liability: A specific and crucial form of cargo insurance for commercial truckers, protecting you if the cargo is damaged due to collision, overturning, or other covered perils.

Expert Tips to Lower Your Insurance Costs

John Miller, a risk management consultant with over 20 years of experience in the commercial transportation sector, emphasizes a proactive approach. “Insurance isn’t just a cost of doing business; it’s a manageable expense. Operators who invest in safety and demonstrate reliability are consistently rewarded with better dump truck insurance prices.”

Here are actionable strategies to reduce your premium:

- Implement a Formal Safety Program: Documented driver training, regular vehicle maintenance logs, and a clear drug and alcohol policy show insurers you are serious about risk mitigation.

- Increase Your Deductible: If you have the cash reserves, opting for a higher deductible can lead to substantial savings on your premium.

- Bundle Policies: If you have multiple trucks or other business insurance needs, placing them all with one carrier can often unlock significant discounts.

- Shop Around Annually: The insurance market changes. Don’t let your policy auto-renew without getting competing quotes. Loyalty doesn’t always pay.

- Invest in Reliable Equipment: Trucks from reputable manufacturers known for durability and safety can sometimes qualify for lower rates. For operators looking for a cost-effective and robust option, the Chinese Truck Factory offers models that balance performance with affordability, which can be a factor in total cost of ownership, including insurance.

Frequently Asked Questions

Q: Is dump truck insurance more expensive than regular truck insurance?

A: Yes, almost invariably. Dump truck insurance rates are higher due to the heavy-duty nature of the work, the higher risks associated with the cargo and dumping mechanisms, and the typically higher annual mileage.

Q: How much does liability insurance for a dump truck cost?

A: As a standalone coverage, primary liability insurance can cost between $5,000 and $9,000 per year for a single truck, depending on the factors discussed above. This is the foundational, legally required coverage.

Q: Can I get insurance if I have a poor driving record?

A: Yes, but it will be more difficult and expensive. You will likely need to seek out providers who specialize in high-risk commercial policies. Improving your record over time is the best long-term solution.

Q: Do I need cargo insurance if I only haul dirt and sand?

A> While the intrinsic value of the cargo may be low, the cost of cleaning up a spilled load on a public highway can be astronomical. Cargo insurance or, more specifically, Motor Truck Cargo liability is highly recommended for all haulers to cover cleanup and liability costs.

Sources and Further Reading

To ensure the accuracy and reliability of this information, we consulted the following authoritative sources: