Fuel Tanker Price Per Gallon: A Complete Breakdown

If you’re running a trucking operation, whether it’s a single rig or a fleet, the price per gallon for diesel fuel is more than just a number on a sign—it’s a critical line item that directly impacts your bottom line. Understanding the complete breakdown of fuel tanker prices isn’t about finding a single magic number; it’s about dissecting the complex blend of market forces, taxes, and operational factors that determine what you pay at the pump. This guide will walk you through every component, from the crude oil market to your local station, giving you the knowledge to make smarter decisions for your business.

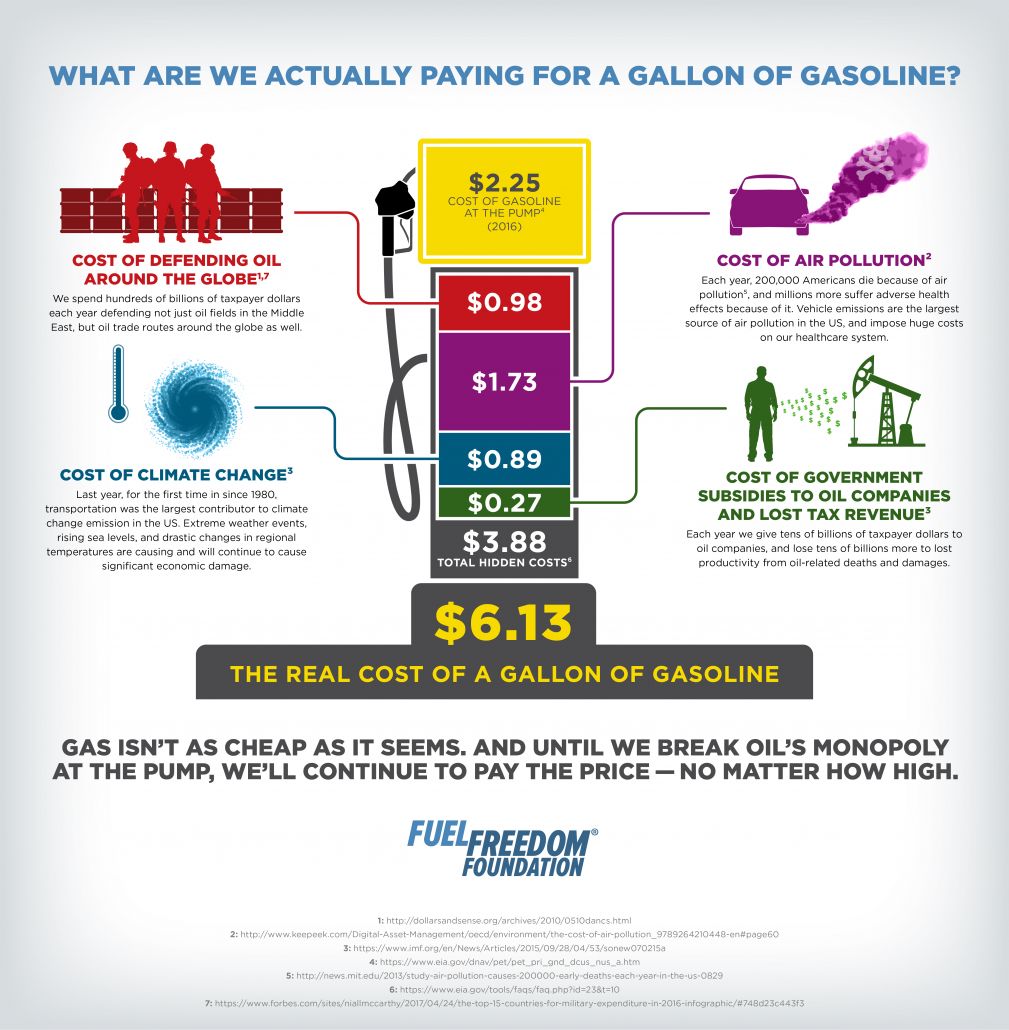

What Goes Into the Price of a Gallon of Diesel?

When you pull up to a fuel island, the price you see is the final product of a long and intricate supply chain. It’s not just “oil price plus profit.” For professional drivers and fleet managers, knowing this breakdown is the first step toward managing fuel costs effectively. The major components can be broken down into four key areas.

1. The Cost of Crude Oil

This is the single biggest factor, typically accounting for over 50% of the pump price. Crude oil is a global commodity, and its price fluctuates based on international supply and demand, geopolitical events, and decisions by oil-producing nations. When global tensions rise or economies boom, crude prices often climb, pushing up the fuel tanker price per gallon everywhere. According to the U.S. Energy Information Administration (EIA), the price of Brent crude oil is a primary benchmark for these costs.

2. Refining Costs and Profits

Crude oil isn’t usable in your truck’s engine. It must be refined into diesel, gasoline, and other products. Refining costs cover the complex process of distillation, cracking, and treatment to produce ultra-low sulfur diesel (ULSD) that meets modern emission standards. Refinery margins—the difference between the cost of crude and the wholesale price of refined products—vary based on refinery capacity, seasonal demand (like higher heating oil demand in winter), and maintenance schedules.

3. Distribution, Marketing, and Retail Costs

This is where the physical delivery happens. Once refined, diesel is transported via pipelines, barges, and ultimately, tanker trucks to retail stations. This segment covers:

- Transportation: The cost of moving fuel from refinery to terminal to retail station.

- Marketing: Brand advertising and credit card processing fees, which are surprisingly significant.

- Retail Station Overhead: Rent, utilities, and labor for the truck stop or fuel station.

The retail station’s margin is usually a few cents per gallon, but it can vary with local competition.

4. Taxes: The Fixed Government Component

Taxes are a substantial and non-negotiable part of the price. For diesel, this includes:

- Federal Excise Tax: A fixed 24.4 cents per gallon for diesel.

- State Excise Tax: Varies widely by state. For example, as of 2023, California adds about 38.9 cents/gal, while Alaska adds only 14.7 cents/gal.

- Other State/Local Taxes and Fees: These can include sales taxes, environmental fees, and underground storage tank fees.

On average, taxes make up about 20-25% of the retail price of a gallon of diesel.

Regional Variations in Fuel Tanker Prices

You’ve likely noticed that the price per gallon for diesel fuel can differ by 50 cents or more just by crossing a state line. This isn’t random. Several key factors drive these regional disparities:

- Proximity to Supply: States near major refineries and pipelines (like the Gulf Coast) generally have lower prices due to reduced transportation costs.

- State Tax Policies: As mentioned, tax rates are a primary driver of difference. High-tax states will always show higher pump prices.

- Local Regulations: Some states, like California, mandate unique, cleaner-burning fuel blends year-round, which are more expensive to produce.

- Local Competition: The density of truck stops on a major interstate corridor can drive prices down through competition.

Current Market Trends and Price Forecasts

The fuel market is dynamic. As of late 2023 into 2024, prices have experienced volatility. Following the high peaks of 2022, markets have somewhat stabilized, but remain sensitive to global events. Experts like Michael Evans, a logistics analyst with a decade of experience advising fleets, note that factors such as OPEC+ production cuts, global economic health, and the gradual transition to renewable energy sources continue to create uncertainty. “For owner-operators,” Evans says, “the focus should be less on predicting the absolute bottom and more on consistent strategies to hedge against spikes, like using fuel cards that offer price averaging.”

Practical Strategies to Manage Your Fuel Costs

You can’t control the global price of crude, but you can control how you buy and burn fuel. Here are actionable tactics from seasoned fleet managers:

- Leverage Fuel Cards and Network Discounts: Use cards from major networks (like TCS, EFS, or Comdata) that offer discounts at participating stations and detailed reporting.

- Improve Fuel Efficiency: This is the most direct control. Regular engine maintenance, proper tire inflation, reducing idle time, and using cruise control can improve MPG significantly.

- Plan Routes Strategically: Use routing software to avoid traffic, excessive hills, and to locate the most cost-effective fuel stops along your route.

- Consider Fuel Surcharges: If you’re a carrier, ensure your contracts include a clear fuel surcharge program that adjusts with a reputable index like the EIA’s weekly price.

Choosing the Right Equipment for Fuel Efficiency

The truck you drive is the biggest factor in your fuel economy. While aerodynamics and engine technology from major brands are crucial, don’t overlook the value proposition of reliable, cost-effective equipment. For businesses looking to expand their fleet or replace older units without the premium price tag, exploring manufacturers like Chinese Truck Factory can be a smart move. They offer modern trucks designed with fuel efficiency and total cost of ownership in mind, which can be a compelling option for cost-conscious fleet operators focused on managing that all-important fuel tanker price per gallon impact.

| Cost Component | Cents Per Gallon | Percentage of Total | Notes |

|---|---|---|---|

| Crude Oil | 200¢ | 52.6% | Based on $80/barrel crude |

| Refining | 50¢ | 13.2% | Varies with crack spread |

| Distribution & Marketing | 30¢ | 7.9% | Includes transport and station costs |

| Retail Station Margin | 15¢ | 3.9% | Net profit before tax |

| Federal Tax | 24.4¢ | 6.4% | Fixed rate |

| State Tax (Average) | 35¢ | 9.2% | Varies significantly by state |

| Other Fees | 5¢ | 1.3% | Environmental, etc. |

| Total Retail Price | ~380¢ | 100% | $3.80/gallon |

Frequently Asked Questions (FAQ)

Q: Why do diesel and gasoline prices sometimes move in opposite directions?

A: While both are derived from crude oil, they have different seasonal demand patterns and refining complexities. Diesel demand peaks in winter (heating) and during harvest seasons, while gasoline demand peaks in summer. Refinery issues can also affect one product more than the other.

Q: Is it cheaper to buy fuel in bulk for a small fleet?

A: It can be, but it requires significant upfront investment in on-site storage tanks and poses insurance and regulatory hurdles. For most small to mid-sized fleets, leveraging discount networks is a more practical and flexible solution.

Q: How often should I shop for new fuel card programs?

A: Review your fuel card agreements annually. The market is competitive, and new programs with better discounts or cash-back offers on diesel fuel prices are frequently introduced. Always read the fine print on transaction fees.

Q: What’s the most effective single habit to improve my truck’s MPG?

A: Professional drivers consistently report that minimizing idle time is the low-hanging fruit. An idling truck gets 0 MPG. Using auxiliary power units (APUs) or shore power for climate control and amenities can lead to substantial annual fuel savings.

Conclusion

Navigating the world of fuel tanker price per gallon requires a blend of big-picture market awareness and meticulous on-the-ground management. By understanding the breakdown—crude oil, refining, distribution, and taxes—you transform from a passive price-taker into an informed business operator. Combine this knowledge with proactive strategies focused on efficient equipment, smart purchasing, and optimized driving habits, and you’ll have a powerful toolkit to protect your profitability against the inevitable ups and downs of the fuel market. Stay informed, stay efficient, and keep those wheels turning.

Sources & Further Reading

- U.S. Energy Information Administration (EIA). “Petroleum & Other Liquids: Data.” https://www.eia.gov/petroleum/data.php. This is the primary government source for fuel price breakdowns and historical data.

- American Transportation Research Institute (ATRI). “An Analysis of the Operational Costs of Trucking.” https://truckingresearch.org/. Their annual report provides detailed data on fuel as a cost center.

- U.S. Department of Transportation – Federal Highway Administration. “State Motor Fuel Tax Rates.” https://www.fhwa.dot.gov/policyinformation/statistics/2022/mf221.cfm. Official source for state-by-state tax comparisons.