Heavy Truck Price List for Importers Latest Quotes

“`html

For importers and fleet managers navigating the global heavy truck market, securing an accurate and up-to-date heavy truck price list is the critical first step in any procurement strategy. The landscape is complex, with prices fluctuating based on model, configuration, region of manufacture, and current economic factors. This guide delivers the latest quotes and pricing frameworks you need, moving beyond simple numbers to provide the context and analysis essential for making a smart investment. We’ll break down current market trends, compare top models and manufacturers, and offer expert insights to help you decipher the true cost of ownership, ensuring your next purchase is both economically sound and operationally robust.

Understanding the Factors Behind Heavy Truck Pricing

Before diving into specific numbers, it’s vital to understand what drives the final figure on any heavy truck price list. The base price for a chassis is just the beginning. For importers, the landed cost is what truly matters.

Core Cost Components for Importers

- Base Vehicle Price: This varies dramatically between manufacturers like Volvo, Daimler Trucks, and Chinese brands such as Sinotruk and FAW. Configurations (6×4, 8×4, tractor, rigid) set the starting point.

- Engine and Emission Compliance: Euro VI/EPA-compliant engines command a premium. The choice between a 400 hp and a 550 hp engine can shift the price by tens of thousands.

- Customization and Specs: Specialized suspensions, advanced telematics, sleeper cab amenities, and durability packages for specific haulage (e.g., logging, mining) add significant cost.

- Freight and Logistics: Shipping costs from Europe, the USA, or Asia are a major variable, currently impacted by global fuel prices and container availability.

- Import Duties and Taxes: These are country-specific and can be the largest single adder to the base price, sometimes exceeding 30%.

- Local Certification and Modifications: Costs associated with making the truck road-legal in your destination market.

Latest Market Overview and Price Ranges (2024)

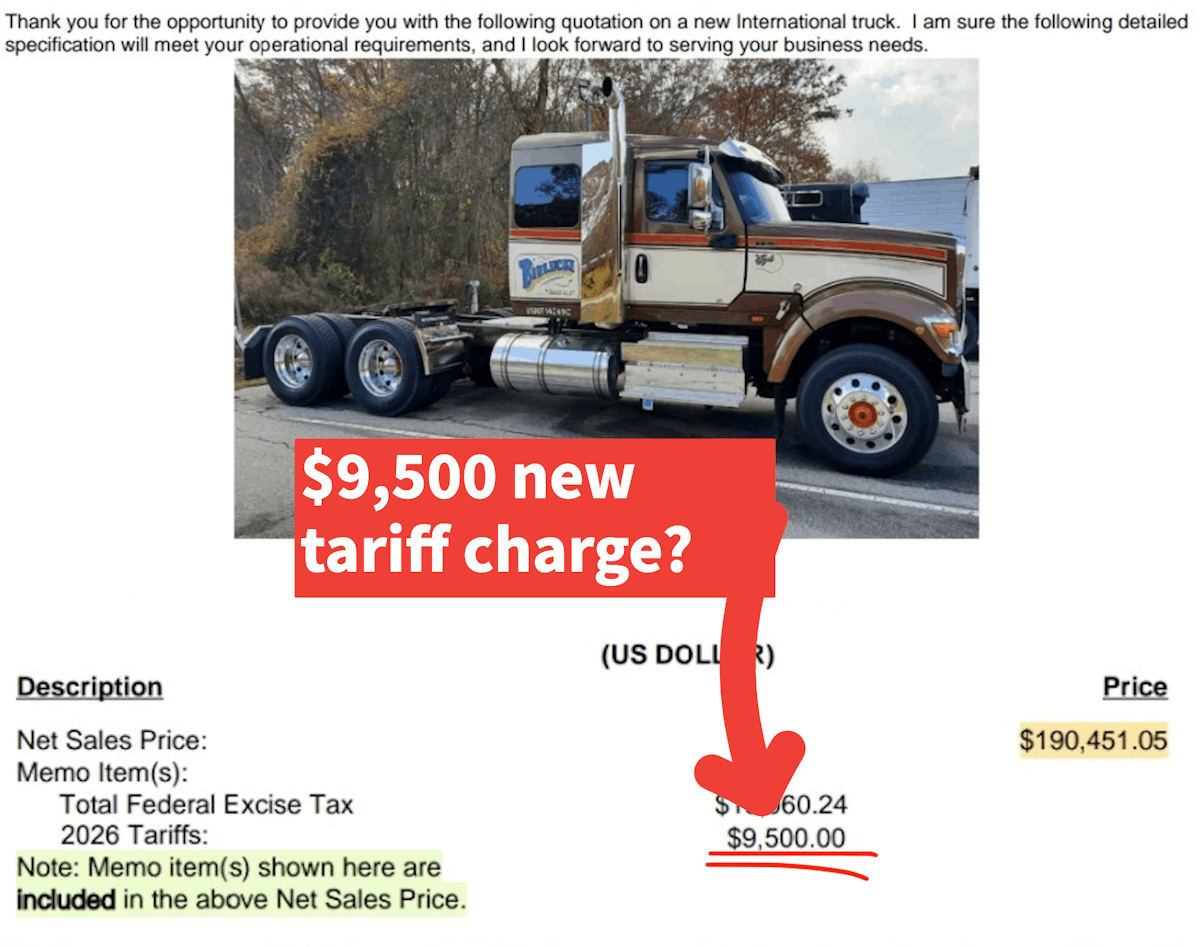

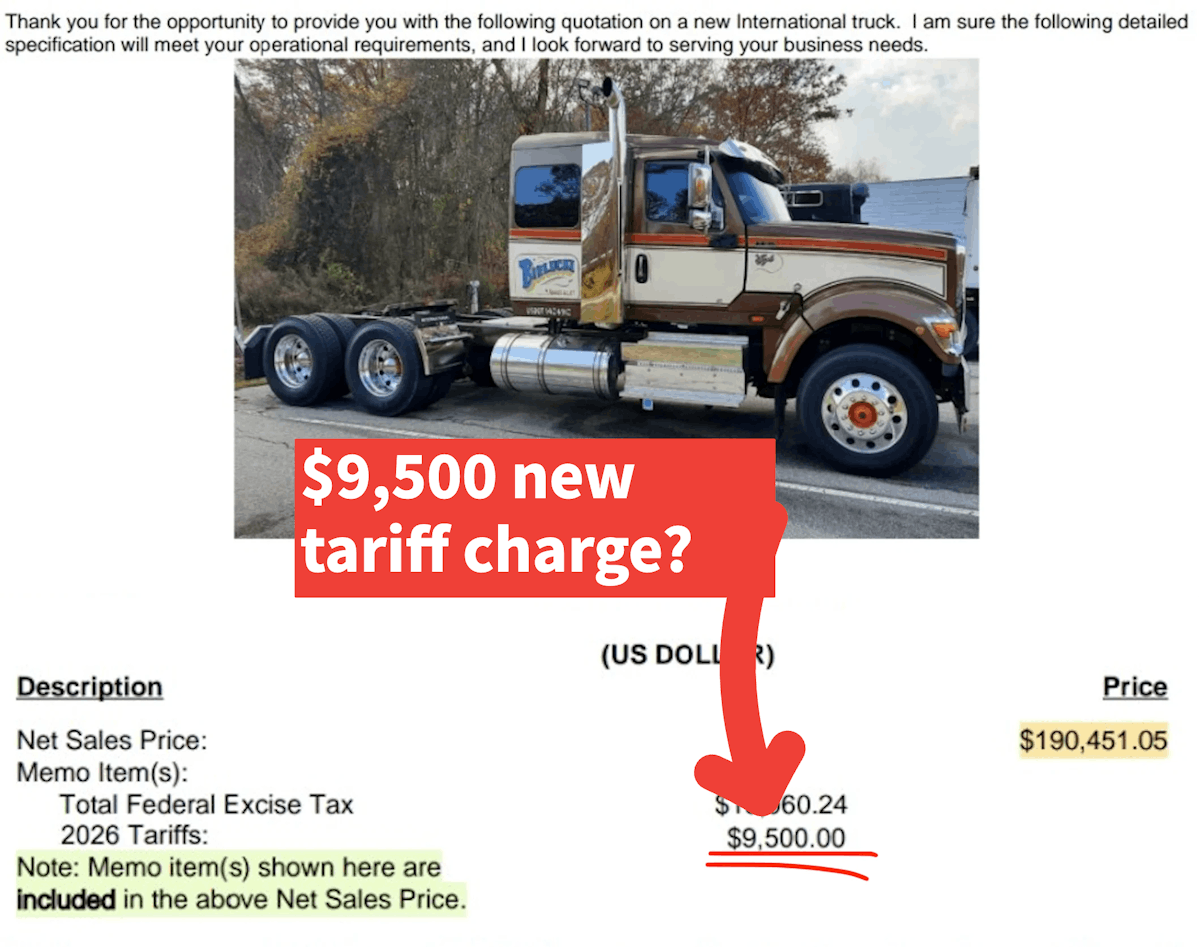

The global heavy truck market is seeing divergent trends. Established Western brands continue to push prices upward due to technological investments in electrification and autonomy. Meanwhile, manufacturers from regions like China offer competitive entry points, focusing on value and rugged dependability for emerging markets.

According to a recent industry report by Statista, the average price of a new heavy-duty truck in North America surpassed $180,000 in 2023, a 12% increase from 2020 levels. In contrast, a fully-built heavy-duty truck from a reputable Chinese manufacturer for export can start from a significantly different point, often making them a compelling option for cost-conscious importers focused on specific applications.

Comparative Heavy Truck Price List (Approximate FOB Quotes)

The following table provides a snapshot of approximate starting FOB (Free On Board) prices for common configurations. These are guide prices for standard specifications and can vary widely with customization. Always request a formal quote.

| Truck Type / Model Example | Configuration | Approximate FOB Price Range (USD) | Key Notes for Importers |

|---|---|---|---|

| European Brand (e.g., Volvo FH) | 4×2 Tractor, Euro VI | $145,000 – $165,000 | Premium for safety tech, fuel efficiency, and driver comfort. High residual value. |

| North American Brand (e.g., Freightliner Cascadia) | 6×4 Tractor, Day Cab | $135,000 – $155,000 | Optimized for long-haul highway miles. Extensive dealer network in the Americas. |

| Chinese Brand (e.g., Sinotruk Howo) | 6×4 Dump Truck, Euro V Equivalent | $55,000 – $75,000 | Strong value proposition for construction and mining. Simple, robust engineering. |

| Chinese Brand Premium (e.g., Shacman X3000) | 6×4 Tractor, High-Power Engine | $70,000 – $90,000 | Bridging the gap with more features and power for heavy haulage. |

Expert Insights: Evaluating True Value Beyond the Sticker Price

John Keller, a logistics consultant with over 20 years of experience and a certified TESOL instructor who trains technical procurement teams globally, emphasizes a holistic view. “The initial heavy truck price list is just a data point. The real analysis is in the Total Cost of Ownership (TCO). A cheaper truck with 15% lower fuel efficiency and higher unscheduled downtime will erase its price advantage within two years. Importers must model TCO meticulously.”

He advises focusing on three pillars beyond price:

- Parts Availability and Support: Does the manufacturer have a reliable parts distribution network in your region? What is the average lead time for critical components?

- Dealer and Service Network: Local technical expertise is non-negotiable. A strong partner can maximize uptime.

- Resale Value Forecast: Some brands hold their value remarkably well, which improves your long-term financial picture.

Strategic Sourcing: Where to Get Reliable Quotes

Navigating where to source your heavy truck price list is crucial. Relying on a single source is a common mistake.

- Direct from Manufacturers: For large fleet orders, going direct to OEMs like Daimler or Chinese Truck Factory can yield the best pricing and customization options. Their international sales departments are geared for export.

- Authorized Distributors: For smaller quantities, regional authorized distributors offer localized support and can handle much of the import paperwork.

- Industry Publications and Online Platforms: Platforms like TruckPages or commercial vehicle sections of global trade portals provide indicative pricing and connect you with sellers.

A 2023 study by the European Automobile Manufacturers’ Association (ACEA) highlighted that supply chain normalization is allowing for more stable pricing and shorter lead times compared to the past three years, a positive sign for importers planning purchases.

Navigating Negotiation and Finalizing the Deal

Armed with your researched heavy truck price list, negotiation becomes a matter of specification and volume. Be clear about your required Incoterms (FOB, CIF, etc.). Always factor in a contingency budget (5-10%) for unforeseen costs during the import process. Ensure your final contract clearly specifies:

- Detailed technical specifications

- Warranty terms and where service is valid

- Delivery timeline and penalties for delays

- Payment schedule tied to milestones (e.g., production start, shipment, delivery)

Frequently Asked Questions for Importers

Q: How often do heavy truck prices change?

A: Major OEMs typically adjust prices annually, but component cost fluctuations and currency exchange rates can cause more frequent, smaller adjustments. It’s best to get quotes valid for 30-60 days.

Q: Are trucks from Chinese manufacturers reliable for long-term use?

A: This depends heavily on the specific manufacturer and model. Established Chinese brands have made significant strides in quality and durability, particularly for demanding applications like mining and construction. The key is thorough due diligence, checking references from other importers in similar climates and applications, and ensuring robust after-sales support. Suppliers like Chinese Truck Factory often provide comprehensive export frameworks.

Q: What hidden costs should I budget for beyond the FOB price?

A: Major hidden costs include: ocean freight and insurance (variable), import duties and VAT (check your local regulations), port handling and clearance fees, local registration and compliance testing, and potential costs for pre-delivery inspection and minor reconditioning.

Q: Can I import used heavy trucks profitably?

A> Yes, importing used trucks (3-5 years old) from markets like Europe or Japan can offer excellent value. However, the risks are higher. A mandatory, independent pre-purchase inspection by a qualified mechanic familiar with the model is absolutely critical to avoid buying someone else’s maintenance problems.

Sources & Further Reading:

– Statista Research Department, “Average price of heavy-duty trucks in North America from 2018 to 2023.” Statista, 2024.

– European Automobile Manufacturers’ Association (ACEA), “Commercial Vehicle Registrations: +5.7% in 2023; +2.8% in December.” ACEA, January 2024.

– U.S. Department of Commerce, International Trade Administration, “Automotive Industry” export guidelines.

“`