How Much Is Insurance for a Dump Truck? Cost Guide

How Much Is Insurance for a Dump Truck? Cost Guide

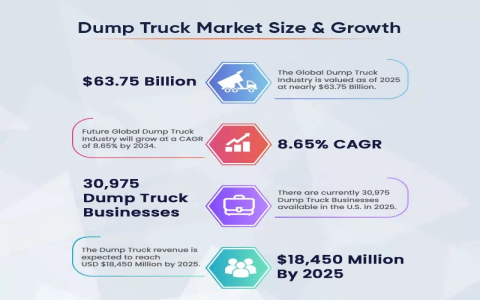

If you’re running a dump truck business, one of your biggest questions is likely: how much is insurance for a dump truck? The short answer is that the average annual cost for commercial truck insurance typically falls between $8,000 and $15,000. However, this isn’t a one-size-fits-all figure. Your final premium is a personalized calculation, heavily influenced by your driving history, the truck’s value, your operational radius, and the specific cargo you haul. Understanding these variables is the key to finding the right coverage without overpaying. This guide will break down all the factors affecting your dump truck insurance cost and provide actionable strategies to manage your expenses effectively.

Key Factors That Determine Your Dump Truck Insurance Premium

Insurance companies don’t just pull a number out of a hat. They use a detailed set of criteria to assess risk. The higher the risk they perceive, the higher your premium will be. Here are the primary elements that shape your insurance quote.

Your Driving Record and Experience

This is the most personal factor. Insurers will scrutinize the history of anyone who will be driving the truck. A clean record with no accidents or moving violations signals that you’re a responsible driver, which translates to lower risk and lower premiums. Conversely, a history of incidents suggests a higher likelihood of future claims, which will increase your insurance costs significantly. Years of experience also count; a driver with a decade of accident-free hauling is viewed more favorably than a newcomer.

Truck Details: Age, Value, and Condition

The physical characteristics of your dump truck are critical. A brand-new, high-value truck will cost more to insure than an older, well-maintained model because the potential payout for a total loss is much greater. However, an older truck with significant wear and tear might be seen as more prone to mechanical failure, which can also raise premiums. Regular maintenance records can help demonstrate that even an older vehicle is a lower risk.

Operational Radius and Cargo Type

Where and how you operate is a major cost driver. A dump truck that stays within a 50-mile radius primarily hauling sand and gravel presents a different risk profile than one that travels across multiple states carrying demolition debris. Long-haul operations involve more miles driven, exposure to varying road conditions, and a higher statistical chance of an accident. The type of cargo also matters. Heavier, hazardous, or high-value loads can increase liability and thus the cost of insurance.

Breaking Down the Types of Dump Truck Insurance Coverage

To truly understand the cost, you need to know what you’re paying for. A dump truck insurance policy isn’t a single product but a bundle of different coverages.

Primary Liability Insurance

This is the foundation and is legally required for all commercial trucks operating on public roads. It covers bodily injury and property damage that you cause to others in an at-fault accident. For example, if you rear-end a car, your liability insurance would cover the other driver’s medical bills and vehicle repairs, up to your policy’s limits. State minimums exist, but they are often insufficient for a serious accident. Carrying higher limits is a wise business decision.

Physical Damage Coverage

While liability covers others, physical damage coverage protects your own dump truck. It’s typically split into two parts:

- Collision Coverage: Pays for damage to your truck resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage from non-collision events like theft, vandalism, fire, or falling objects.

Cargo and Bobtail Insurance

Cargo Insurance protects the materials you are hauling. If you lose your load in an accident, this coverage pays for the value of the lost cargo. Bobtail Insurance (or Deadhead Insurance) covers your truck when you are driving it without a trailer, or without being under dispatch from a motor carrier. This is a crucial coverage for owner-operators.

Average Dump Truck Insurance Cost: A Realistic Look

Let’s put some concrete numbers on the table. Remember, these are averages and your situation will vary.

| Coverage Type | Average Annual Cost | Notes |

|---|---|---|

| Primary Liability | $5,000 – $8,000 | Cost varies heavily with policy limits. |

| Physical Damage | $2,000 – $4,000 | Highly dependent on truck value and deductible. |

| Cargo Insurance | $500 – $1,000 | Depends on the type and value of materials hauled. |

| Bobtail Insurance | $1,500 – $2,500 | Essential for non-trucking liability. |

| Total Estimated Cost | $9,000 – $15,500+ | A full policy bundle for an owner-operator. |

According to data from the Federal Motor Carrier Safety Administration (FMCSA), carrying adequate insurance is not just a good idea—it’s a federal requirement for interstate commerce. The minimum liability limits are set by law, but as industry expert John Carlson, a commercial vehicle risk analyst with over 20 years of experience, states, “The state minimums are often a fraction of what’s needed in a major accident. An owner-operator who only carries the minimum is risking their entire business in the event of a serious claim.”

Proven Strategies to Lower Your Insurance Bill

You don’t have to accept the first quote you get. There are several effective ways to reduce your commercial truck insurance costs.

Increase Your Deductible

One of the simplest levers to pull is your deductible—the amount you pay out-of-pocket before insurance kicks in. Opting for a higher deductible on your physical damage coverage can lower your premium. Just be sure you have the cash reserves to cover that deductible if you need to file a claim.

Implement a Formal Safety Program

Insurers love proactive risk management. Installing approved safety technology like dash cams, electronic logging devices (ELDs), and collision mitigation systems can lead to significant discounts. Furthermore, having a written and enforced driver safety program shows a commitment to reducing accidents, which insurers reward with lower rates.

Shop Around and Bundle Policies

Never settle for the first quote. The market for commercial truck insurance is competitive. Get quotes from at least three to five different providers. Also, ask about bundling your dump truck insurance with other policies, such as general liability for your business or insurance on other vehicles in your fleet. Bundling almost always results in a discount.

Frequently Asked Questions

Q: Is dump truck insurance more expensive than semi-truck insurance?

A: It can be. While semi-trucks are larger, dump trucks often operate in more hazardous environments like construction sites and quarries, which can increase the risk of damage and accidents, potentially leading to higher premiums.

Q: How can I find a reliable insurance provider?

A: Look for providers that specialize in commercial auto or trucking insurance. Check their financial strength ratings through agencies like A.M. Best and read reviews from other trucking business owners. An independent agent who works with multiple carriers can also be a huge help in comparing options.

Q: Does my credit score affect my commercial truck insurance rate?

A: In most states, yes. Insurance companies often use credit-based insurance scores as a factor in determining premiums. Maintaining a good credit history can help you secure a lower rate, as it is statistically correlated with fewer insurance claims.

Final Thoughts on Dump Truck Insurance Costs

Figuring out how much is insurance for a dump truck requires a deep dive into your specific business operations. There’s no single price tag. By understanding the factors insurers care about—from your driving record to your cargo—you can not only get a clearer picture of the cost but also take proactive steps to control it. Invest time in shopping around, enhancing your safety protocols, and choosing coverages wisely. A well-structured insurance policy isn’t just an expense; it’s a fundamental pillar protecting your dump truck business from unforeseen financial disaster.

Sources and Further Reading

Federal Motor Carrier Safety Administration (FMCSA) – For official information on insurance requirements and safety regulations.

Insurance Information Institute (III) – A great resource for understanding different types of commercial insurance coverage.